How to Incorporate the Pillars of OFAC into an Effective Compliance Program?

Every financial business established across the globe is mandated to adhere to economic sanctions set by the U.S OFAC. Pillars of OFAC are involved in shaping as well as enacting major U.S. sanctions regimes, which aim at blocking improper states, reprobate characters, and other threats to American security.

To help companies reinforce their OFAC compliance efforts, it’s important to understand OFAC’s four pillars of enforcement that shape its approach.

As former OFAC Director Adam Szubin explained, “Sanctions compliance is more important than ever in today’s interconnected world.” Szubin articulated that “sanctions evasions can now spread rapidly, endangering national security and undermining the goals of U.S. foreign policy.”

The following article will discuss how to implement the pillars of OFAC into an effective compliance program.

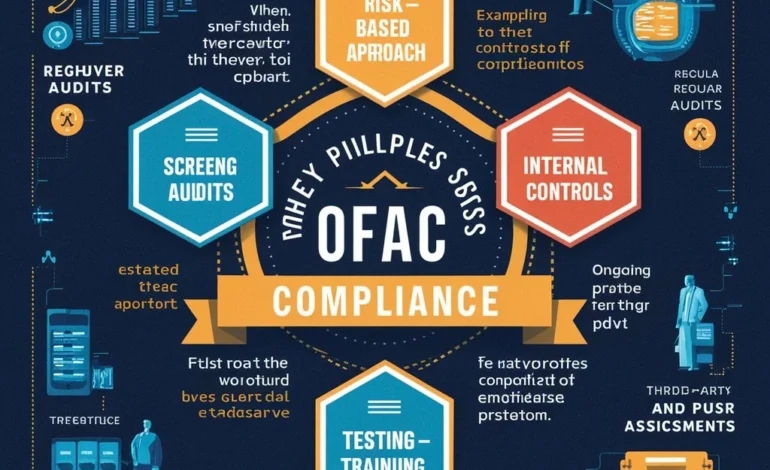

The Four Pillars of OFAC

- Identification

Identification is the first and crucial step. It involves coming to an understanding and recognition relating to the risks tied up with sanctions.

This includes customer due diligence, in-depth risk analysis, and advanced screening technology to enhance efficiency in compliance with OFAC regulations.

Also Read: Understanding Shell Firms: High-Risk Entities in Corporate

2. Prevention

Prevention means not engaging in prohibited activities. This will entail the development of sound internal policies and procedures for their implementation. Regular training for employees, and the application of technology solutions for automated screening and monitoring processes.

3. Detection

It detects violations quickly. Procedures for the continuous monitoring of transactions, frequent audits, and clear reporting protocols are essential for detecting suspicious activities and thus ensuring compliance with OFAC standards.

4. Resolution

The resolution addresses and resolves any identified issues to prevent recurrence by such actions as investigation, corrective actions, and detailed recording of all compliance proceedings to show sincerity to the OFAC regulations.

Setting Up Compliance Policies

In developing compliance policies that adhere to OFAC regulations, it becomes imperative to focus on the Pillars of OFAC enforcement.

It shall start with a strong identification of possible sanction-related risks. Recent reports reflect an increase in OFAC penalties notably more than $1 billion in fines levied in the latest fiscal only.

While this comprises risks, such can be effectively countered by proper risk profiling and stringent customer due diligence. There must be policies prescribing how to proceed with high-risk transactions and jurisdictions and ensure good OFAC compliance.

Bonus: Elaborate on the intricacies of OFAC compliance to expert observance, which will help pave the way for an optimum regulatory approach for any business.

Read More: FintechZoom Facebook Stock: The Ultimate Guide

Conduct Screening and Monitoring

Screening and monitoring are effective for the OFAC compliance program. Technological advances have considerably enhanced the screening process. Especially when performing real-time checks against OFAC’s Specially Designated Nationals (SDN) and other sanction lists.

A step ahead like that enables early detection of possible breaches and lowers legal and reputational risks. Regular audits and reviews of the compliance program are critical in maintaining your organization’s compliance with changing OFAC requirements.

Organizations must also develop safe and effective reporting mechanisms to ensure that when monitoring mechanisms raise a red flag, the institutions will respond quickly.

Implementing an OFAC Training Program

Have your people undergone training to understand the intricacies of OFAC compliance? A far-reaching OFAC training program is imperative to meet regulatory requirements.

Such training needs to deal with the four Pillars of OFAC enforcement that have to do with the identification, prevention, detection, and resolution of sanctions-related risks.

In this respect, it is also very important to note how efficient periodic training may prove in reducing the number of compliance violations by up to 40%. Setting up a culture of compliance within an organization can be done by educating staff necessary to understand the essence of OFAC screening and monitoring.

In that respect, different roles in any given organization in the actual conducting of OFAC list screening. Processing of transactions involving high-risk entities should be customized under a training program.

Auditing and Enforcement

What steps will keep your OFAC compliance program vigorous and effective? To ensure integrity in the regulatory framework, a program of auditing and enforcement becomes very important.

An audit of the OFAC screening processes and the internal controls should be conducted repetitively to identify the gaps or weaknesses that might be there. Regulatory updates over the recent period have increased their emphasis on strong enforcement measures, with penalties for non-compliance running into record highs.

The pillars of OFAC enforcement could give organizations a clear alignment of audit procedures with a proactive resolution of compliance issues and risk mitigation. To that effect, the enforcement mechanisms shall provide for the prompt resolution of the identified violations. Clearly stating policies and documentation for demonstrating adherence to the OFAC regulations.

Enhancing Regulatory Compliance

What remains paramount for any financial institution looking to sail through the regulatory landscape today is the integration of OFAC pillars into an effective compliance program.

The identification, prevention, detection, and resolution strategies are major steps toward attaining compliance with OFAC regulations.

Development of strong compliance policies, thorough screening, and monitoring with support from comprehensive training programs. Rigid auditing and enforcement policies at organizational levels can reduce the risks associated with sanctions violations.

Such proactive steps do not simply help prevent further sanctions but contribute to national security. Agenda of the United States and U.S. foreign policy objectives in an increasingly globalizing economy.